IFTA Filing Software

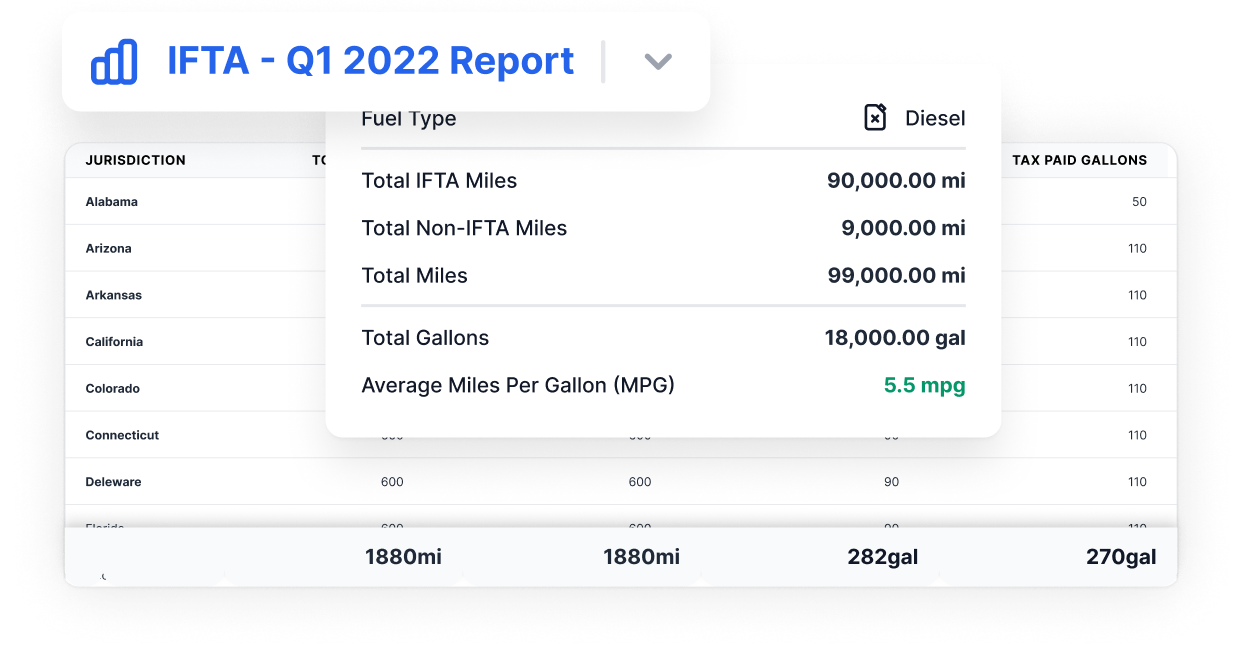

Save time, automate manual workflows, and ensure you get your quarterly reports done on time with Toro’s one-click IFTA Reporting.

Faster and more accurate.

Get your IFTA reporting done faster and more accurately with Toro TMS. Toro takes the data from your fuel cards and mileage from your ELD to automatically calculate your IFTA taxes.

Manual fuel tracking to remain in compliance with the International Fuel Tax Agreement (IFTA) can be complex and costly if it’s done incorrectly. Beat the quarterly due date and get ahead of IFTA tax processes with an automated system that truly does do it all.

Keep reading to understand what you can get from Toro's International Fuel Tax Agreement tool.

Toro’s IFTA Filing Software

Automatically calculates IFTA taxes based on fuel import file and mileage from your ELD.

This form of ongoing recording gives you the most complete information and metrics to help you e-file later with your base jurisdiction. It also saves you the effort of looking across multiple data sources (such as fuel tax reports and previous IFTA account statements) to make your IFTA calculations.

Breaks down IFTA information on a per-truck basis.

Helps you easily calculate IFTA-related deductions for each owner-operator. You can then enter this in the driver management section of Toro and have it seamlessly show up in driver settlements.

Automatically calculates miles driven in KY, NM, NY and OR for weight-distance tax filing, saving you time and resources each time you file your quarterly tax return documents.

Reduces manual work you have to do to handle complex states, as they may have more vigorous filing requirements. Toro TMS keeps record keeping simple and accurate across your IFTA-related tax forms for the highest level of compliance possible.

Offers more in-depth metrics than other competing tools, showing granular reporting capabilities for the most accurate published information.

Enables you to dig deeper into the state-by-state calculation if necessary for an audit or other verification.

Generates a report with all IFTA calculations that you can export through our user-friendly software, allowing you to e-file in just a few clicks.

Enables you to easily enter this information into your jurisdiction’s filing system, as well as keep it for your records.

"I feel very comfortable passing IFTA onto our safety manager now that Toro has significantly simplified it"

- Basem Sabbara, Liberty Transportation